Brands and retailers ‘sleighed’ the 2021 holiday season as shoppers stuffed their festive carts and checked out with products across verticals.

Preliminary results from Mastercard[*] showed a healthy resurgence of consumers’ appetite for eCommerce holiday shopping. Retail sales grew 8.5% between November 1 and December 24 compared to the same period in 2020. More consumers also continued to shop online. eCommerce sales expanded to 11%, comprising 20.9% of total retail sales.

While overall sales remained above 2020 levels, holiday spending slowed down toward the end of 2021 according to Earnest Research[*] due to the prolonged impact of COVID-19. What do these numbers say about what’s expected for eCommerce in 2022?

To help set the course for a successful year ahead, we analyzed user session data to uncover insights from the major holidays of Q4 including Black Friday, Cyber Monday, Christmas, and New Year’s.

By looking at metrics from 2020 and 2021, this report sheds light on holiday shopping habits by industry so that brands can leverage this data for their 2022 holiday eCommerce campaigns and strategies.

Q4: Shopping Online Remains Strong

Black Friday: Breaking a Growth Streak

Cyber Monday: Completing Shopping Journeys

Christmas + New Year’s: Gearing up for 2022

Key Findings

- HEALTH & BEAUTY REACHED TWO-DIGIT CVR ACROSS 3 HOLIDAYS

Shoppers are prioritizing health and wellness, and it shows. Along with Gifts & Hobbies, Health & Beauty reached two-digit conversion rates in Q4 2021, reaching as much as 14.03% CVR on Cyber Monday. Meanwhile, the average CVR across all industries between January 2021 and November 2021 was 2.9%. - SHOPPERS VIEWED 1.25 TIMES MORE PAGES PER SESSION ON AVERAGE IN Q4 2021 VS Q4 2020

Compared to the same period the previous year, pages per session increased to reach an average of 4.11 across all industries from October to December 2021. Shoppers spent more time engaged online, with less exposure to unwanted third-party ads. - DURING BFCM, JOURNEY INTERRUPTIONS OCCURRED MOST IN BIG-TICKET AND HIGH COMPETITION COMPUTER AND OFFICE SUPPLIES INDUSTRY

Unauthorized ad injections are prevalent in Computer & Office Supplies. Products in this vertical are high-ticket, attracting not only brand-led ads and campaigns but also unwanted third-party injections. In fact, 1 In 5 customer shopping journeys for computer and office supplies were interrupted. On Black Friday and Cyber Monday, the number of customer journeys interrupted in this segment grew 72.49% and 84.65% year over year, respectively. - LESS ABANDONED CARTS IN NONESSENTIAL INDUSTRIES

Footwear, Travel, Fashion & Apparel, and Home enjoyed an improvement in cart abandonment in Q4 2021, with Footwear having the least carts abandoned at 63.09% in the same period. Consumers are showing signs of moving on to post-pandemic life, ready to go back out again in 2022.

Q4: Shopping Online Remains Strong

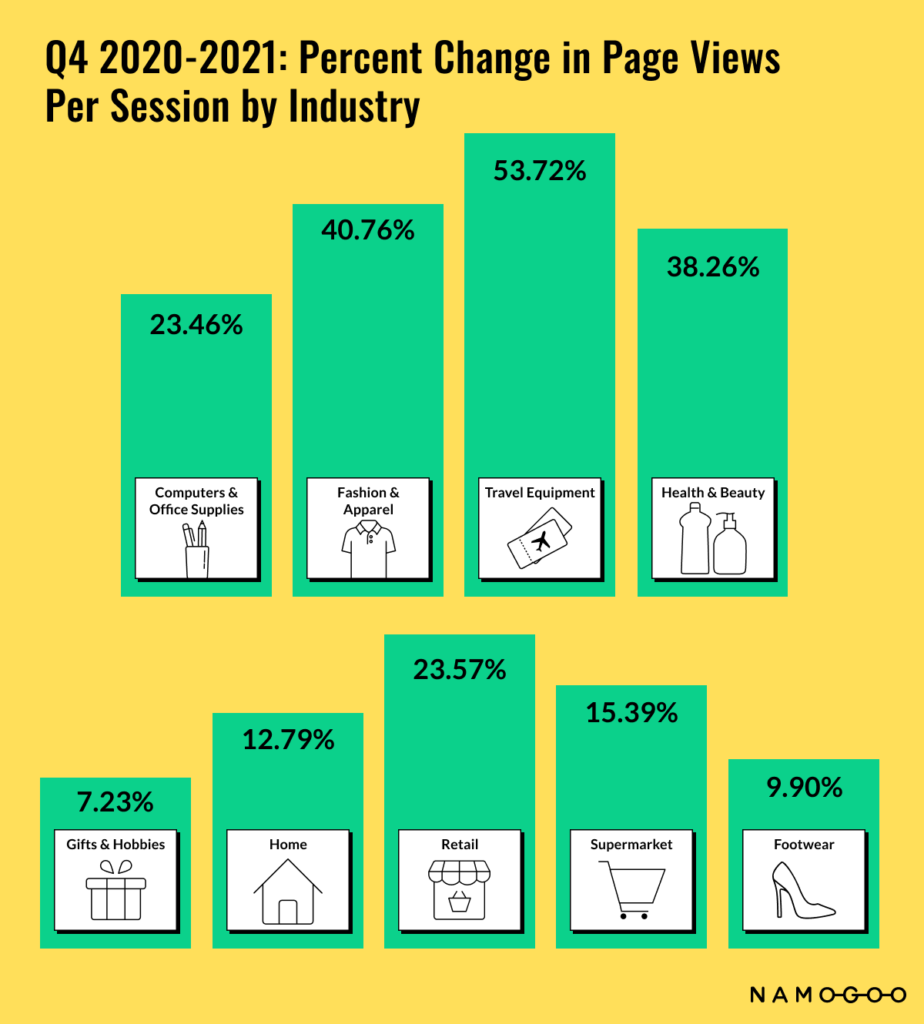

With the number of digital shoppers[*] expected to reach over 2.14 billion in 2021, brands and retailers not only experienced increased sales, but they also experienced higher traffic and time spent on sites than last quarter. From October to December 2021, shoppers across industries explored more pages compared to the same period in 2020. Travel, Fashion & Apparel, and Health & Beauty registered the highest increase year over year in pages viewed per session at 53.72%, 40.76%, and 38.26%, respectively.

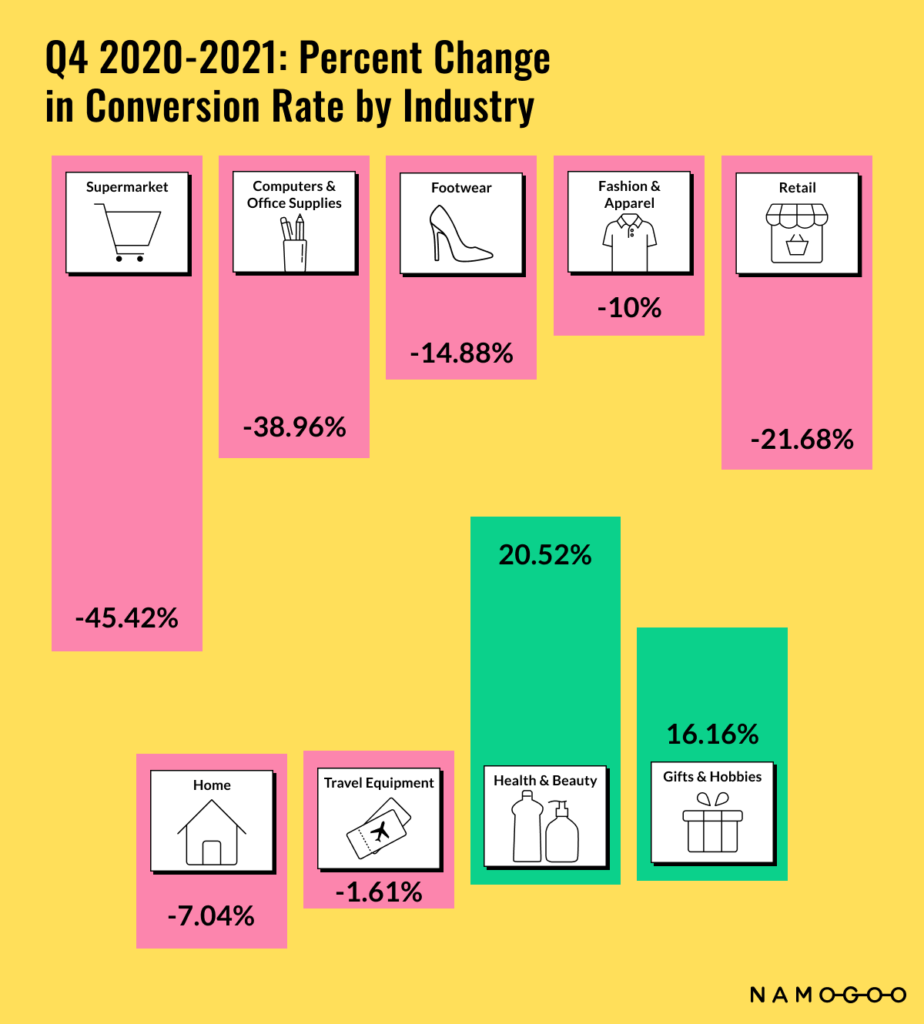

True to the holiday spirit, Gifts & Hobbies, along with Health & Beauty, enjoyed positive CVR growth, reaching 16.16% and 20.52% year over year, respectively. On the other hand, the top three industries with the biggest drop in CVRs were Supermarket, Computer & Office Supplies, and Retail.

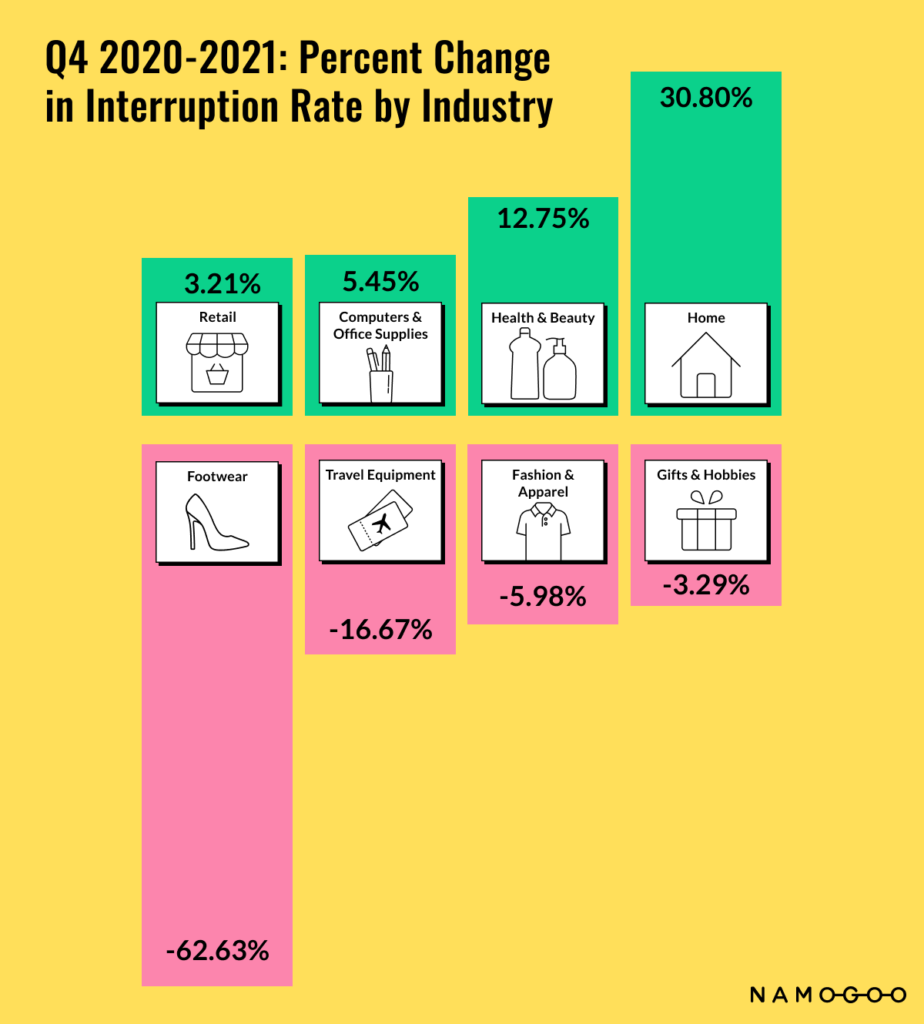

Customer journey interruptions was present across all industries, but Home registered the highest number of shoppers exposed to unwanted third-party ads. In addition to lower CVR in 2021, the industry also experienced an increase of 85.63% year over year in checkout abandonment. In fact, the checkout abandonment rate for the Home category increased by 85.63% from Q4 in 2020 to Q4 in 2021.

Relating the data analysis to NRF’s[*] 2021 Consumer Holiday Survey that found:

“Consumers continue to state a strong preference for online shopping. Over half (57%) plan to purchase holiday items online this year, down from 60 percent who identified online as a holiday destination in 2020 and in line with pre-pandemic norms.”

While consumers are showing signs of exploring pre-pandemic shopping destinations, eCommerce remains a strong channel for holiday shopping. Brands and retailers that can keep the momentum going would spend time optimizing the online customer experience, from connecting shoppers to the right products and offers, to improving the checkout experience especially for Gifts & Hobbies and Home verticals.

Home products are often big-ticket items that require shoppers to be 100% sure when purchasing. So, in addition to blocking competitor ads and browser extensions that undermine customer journeys, brands and retailers can look into user experiences that build trust in 2022. This can include highlighting social proof, providing sufficient product information and images, and being transparent about payment options and return policies.

Black Friday: Breaking a Growth Streak

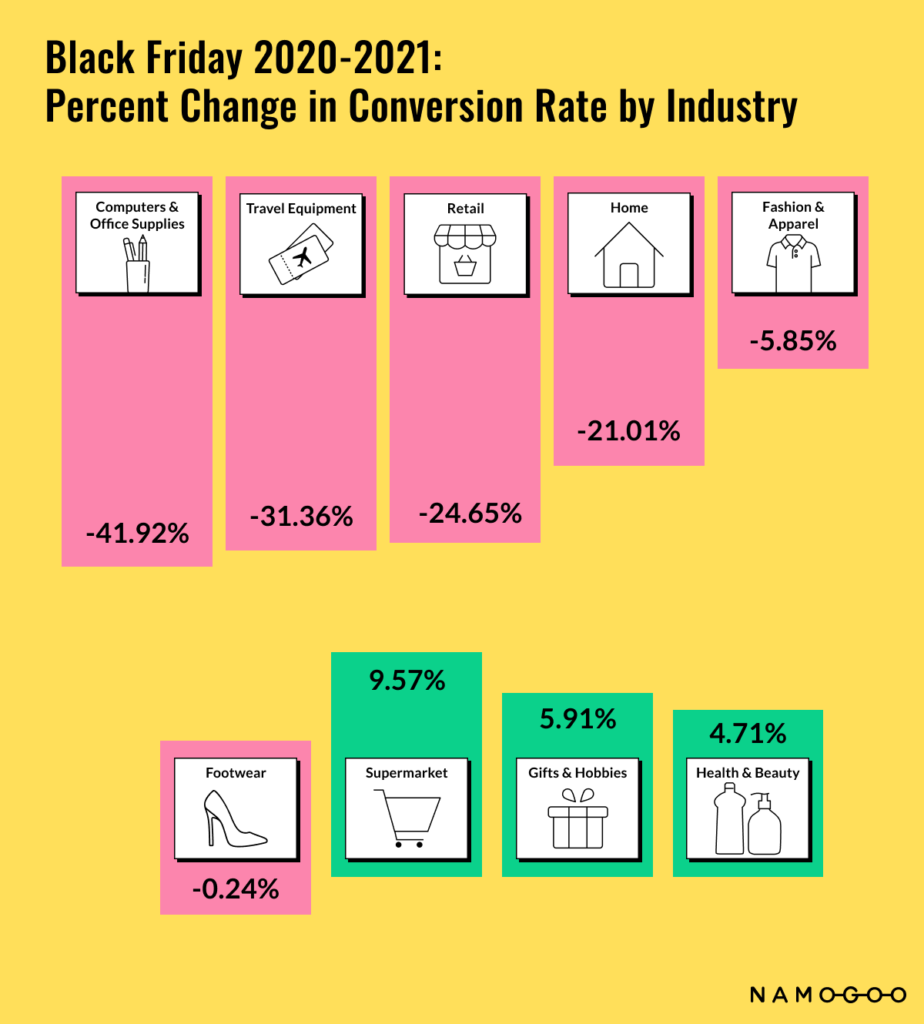

Black Friday is a highly anticipated shopping season for both shoppers and retailers that consistently generate more sales every year—until 2021. According to Adobe Analytics[*], online sales during Black Friday decreased by 1.12% year over year, settling at $8.9 billion. As user session data revealed, 6 out of 9 industries had lower CVRs in 2021 compared to 2020.

On the other hand, CVRs increased in Gifts & Hobbies, Health & Beauty, and Supermarket as these are necessities that attracted shoppers on the hunt for discounts.

Following the trend of consumers venturing back to out-of-home activities, Footwear registered a decrease in cart abandonment and checkout abandonment by 4.83% and 22.86% year over year, respectively.

For the first time in years, sales performance during Black Friday dipped compared to 2020 levels. Many factors could’ve come into play–from unwanted ad pop-ups that derailed shoppers from completing their purchases on brand sites to the ongoing impact of COVID-19. Consumers might have planned and bought ahead of time as well due to out-of-stock and timely delivery concerns. In relation, Deloitte[*] found that 37% of shoppers agreed that there are better deals early in the season.

In 2022, brands and retailers should prepare for a different kind of holiday rush. Starting holiday promos early can help not only to manage product availability and fulfillment issues, but also match what holiday shoppers would be looking for: Better deals ahead of the usual start of the holiday season. To address rising inflation that lessened the extent of discounts on offer, it’s important for brands and retailers to make sure that promos are personalized to each individual shopper to guarantee a return on investments.

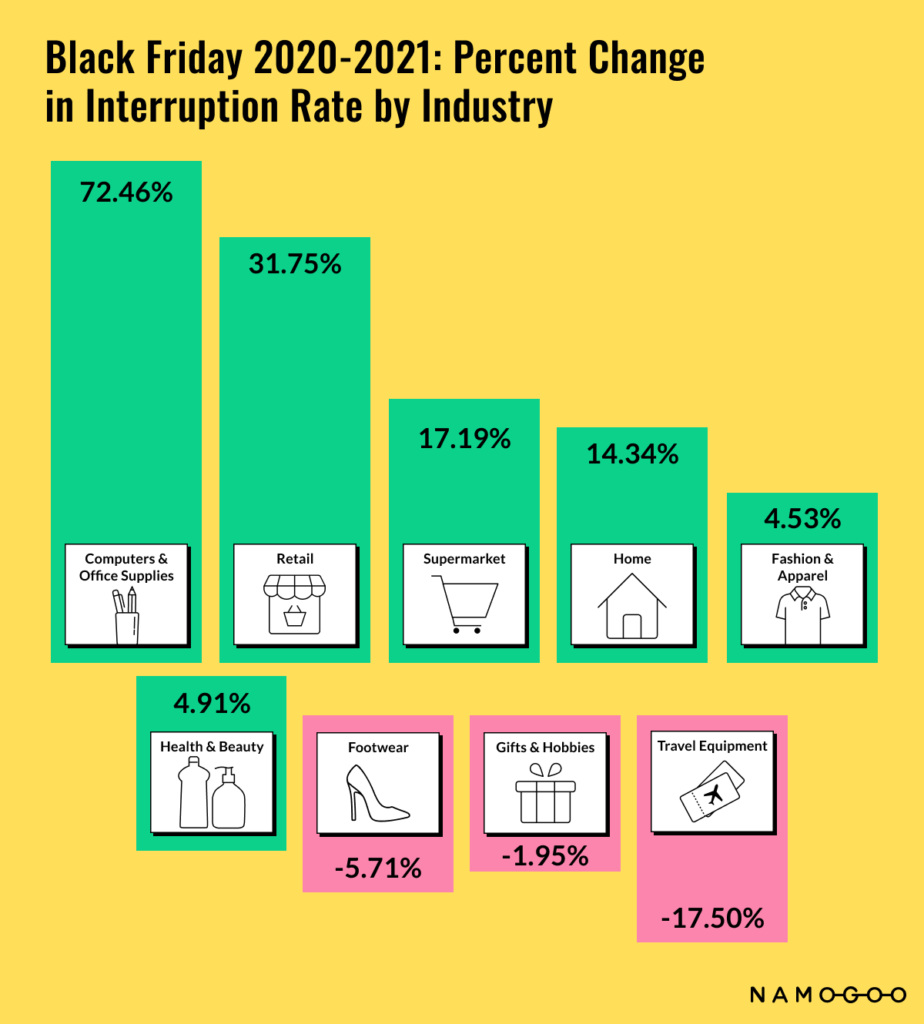

There’s no one reason for the dip in sales and CVRs. It could be unauthorized ads hurting customer journeys as most industries experienced an increase year over year in interruption rates. Despite the growth in pages viewed per session in almost all industries, the lower CVRs can be attributed to the lingering impact of the pandemic. Product unavailability, supply chain issues, and rising inflation did lessen the extent of discounts that brands and retailers were able to offer[*]. Deals as early as October can also be another reason for the diminished sales.

Cyber Monday: Completing Shopping Journeys

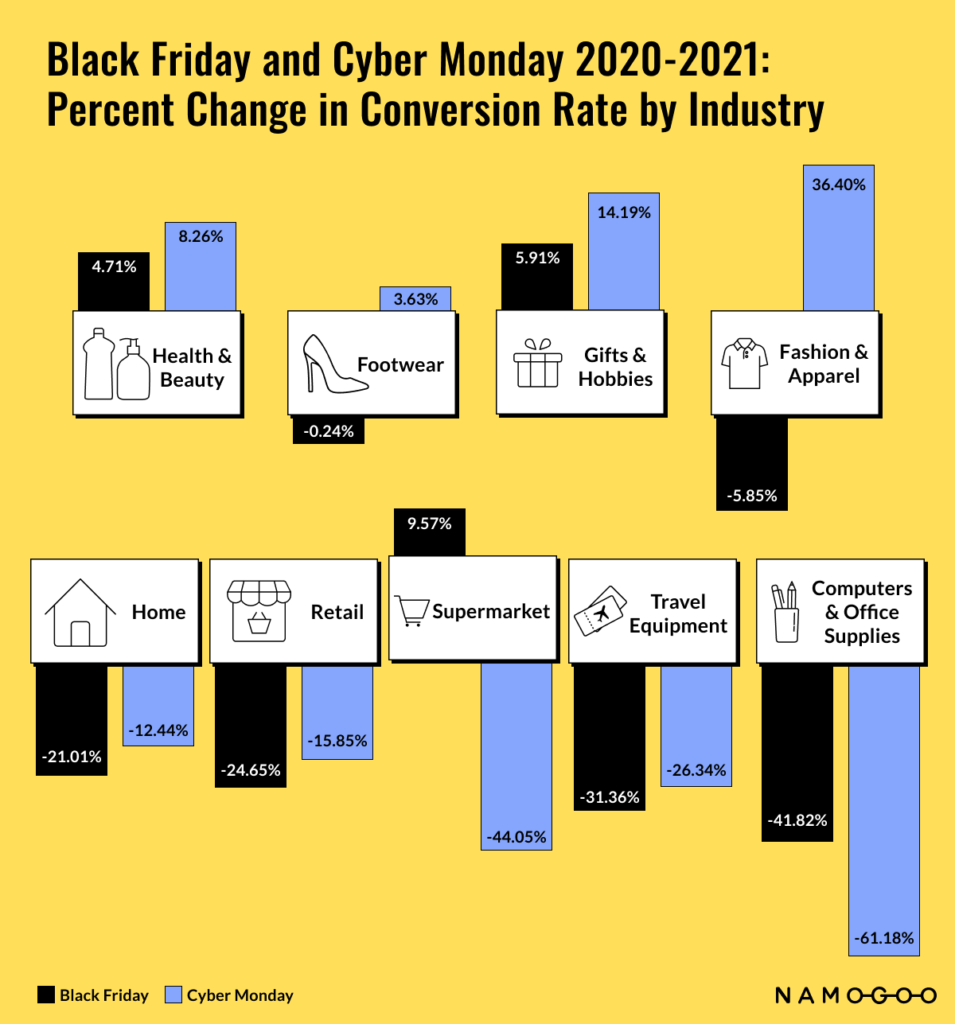

Similar to Black Friday, online sales on Cyber Monday[*] dipped by 1.4% year over year. With a total of $10.7 billion in sales—just $100 million shy from 2020’s numbers—Cyber Monday remained the biggest online shopping day of the year. Moreover, from November 1 to 29, online spending already reached $109.8 billion, growing at 11.9% compared to the same period in the previous year.

The better outcomes on Cyber Monday than Black Friday can be attributed to the culmination of Thanksgiving weekend. Shoppers who were waiting for deeper discounts might have decided to finally purchase the products they’ve been eyeing on before Cyber Monday ended.

Being the biggest online shopping day of the year, it’s understandable that more unauthorized ad injections competed against brand-led campaigns and ads. Particularly in the Computer & Office Supplies industry where products are high-ticket, more customer journeys were redirected away from brand sites. For Black Friday and Cyber Monday 2022, retailers wanting to keep organic traffic and high-intent shoppers could consider tools that ensure shoppers stay on brand channels by removing interruptions from the customer journey.

Analyzing eCommerce page views and sessions, notable during Cyber Monday 2021 was how CVRs performed better in Fashion & Apparel, Footwear, Gifts & Hobbies, and Health & Beauty than Black Friday’s. Last-minute shoppers could’ve waited for bigger deals before finally pulling the plug before Cyber Week ended.

Fashion & Apparel, along with Footwear, showed positive CVR growth and less cart abandonment year over year. As forecasted by McKinsey & Co.[*], spending on discretionary products was expected to increase by 11% from 2020 to 2021.

There’s room for improvement in terms of customer journey interruption, especially in the Computer & Office Supplies industry, as about 85% more shoppers’ journeys were interrupted during Cyber Monday 2021 compared to the same holiday period the previous year.

Christmas & New Year’s: Gearing Up for 2022

Towards the end of the 2021 holiday season, consumers continued to shop and buy online. Both last-minute holiday shoppers and those looking forward to the next year probably drove sales activities during this period.

In fact, along with Cyber Monday, spending on discretionary and travel and entertainment products increased on Christmas and New Year’s. This could be a signal that shoppers are gearing up for more out-of-home activities in 2022. Frictionless experiences could also be another reason for the overall good performance of the Christmas and New Year’s shopping period as customer journey interruptions decreased in all industries.

With the prolonged pandemic in the background, brands and retailers should closely monitor changing consumer sentiments and behavior as the festive shopping season in 2022 approaches. To keep the interests of consumers exposed to consistent discounts by the start of Q4, creative offers could be a differentiator. These can include surprise gifts, game-based promos, time-sensitive product launches, and always fresh on-sale collections

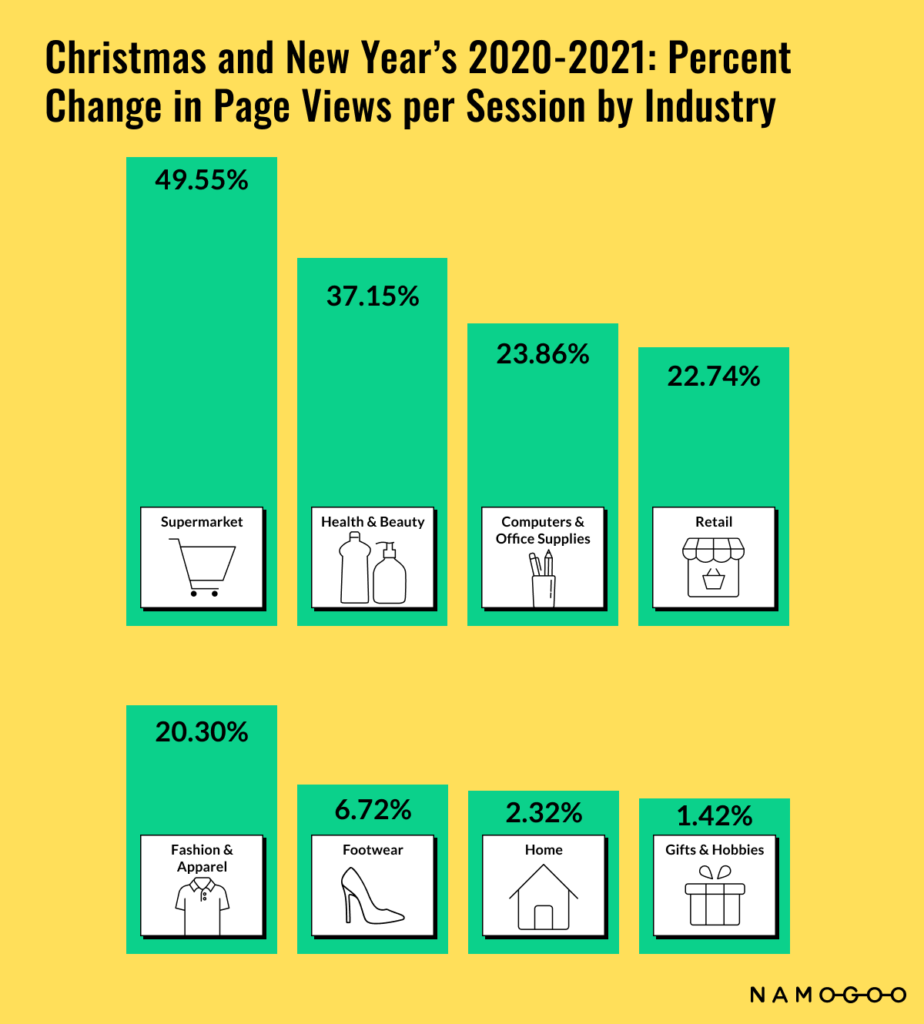

In December 2021, all industries experienced growth in the number of pages viewed per session. Shoppers spent the most time looking at site pages of Supermarket, Health & Beauty, and Computer & Office Supplies retailers, experiencing year over year growth of 49.55%, 37.15%, and 23.86%, respectively.

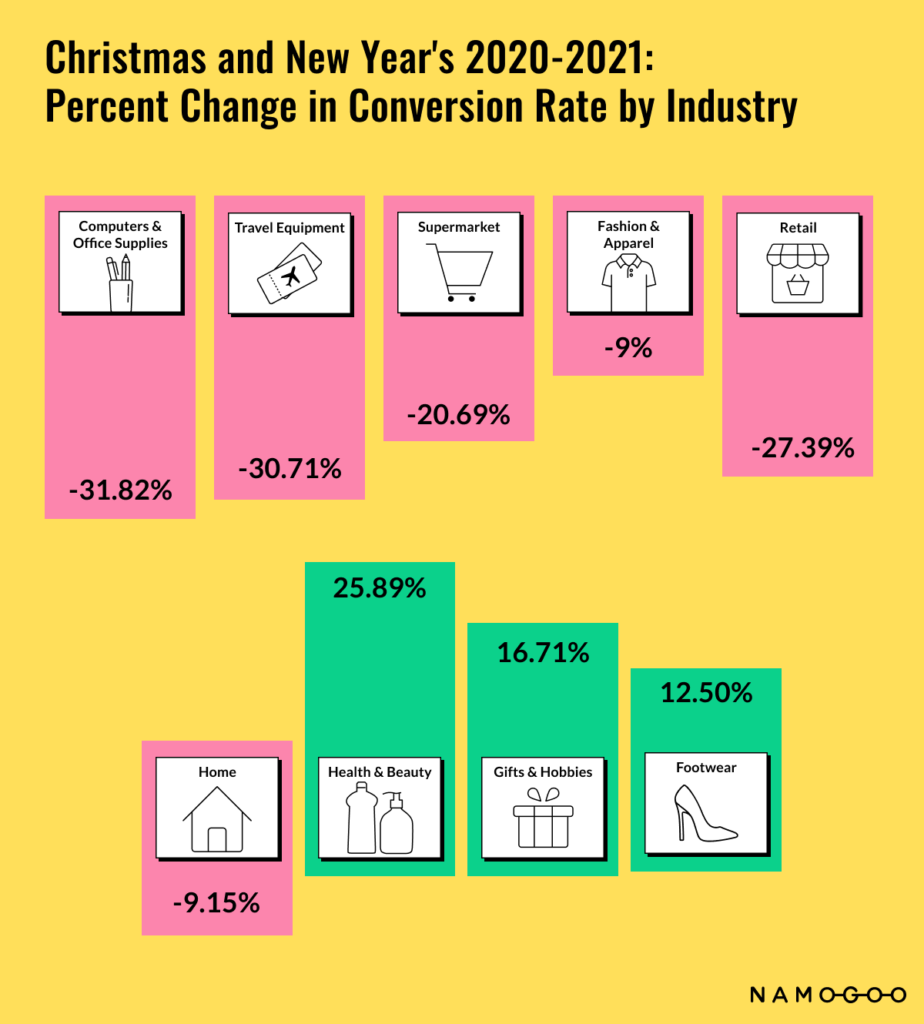

With smooth customer journeys also come better CVRs. Health & Beauty CVR grew 25.89% year over year, followed by Gifts & Hobbies and Footwear. By removing interruptions, cart abandonment and checkout rates improved for Travel as well.

The growth in Travel numbers can be a sign of consumers making 2022 the year of going back to traveling and experiential activities. Accenture[*] found that 36% of shoppers were planning to take a local trip or vacation this year. Over 1 in 4 consumers were also keen on making dining out, cinema, theatre, and other experiences a top financial priority in 2022.

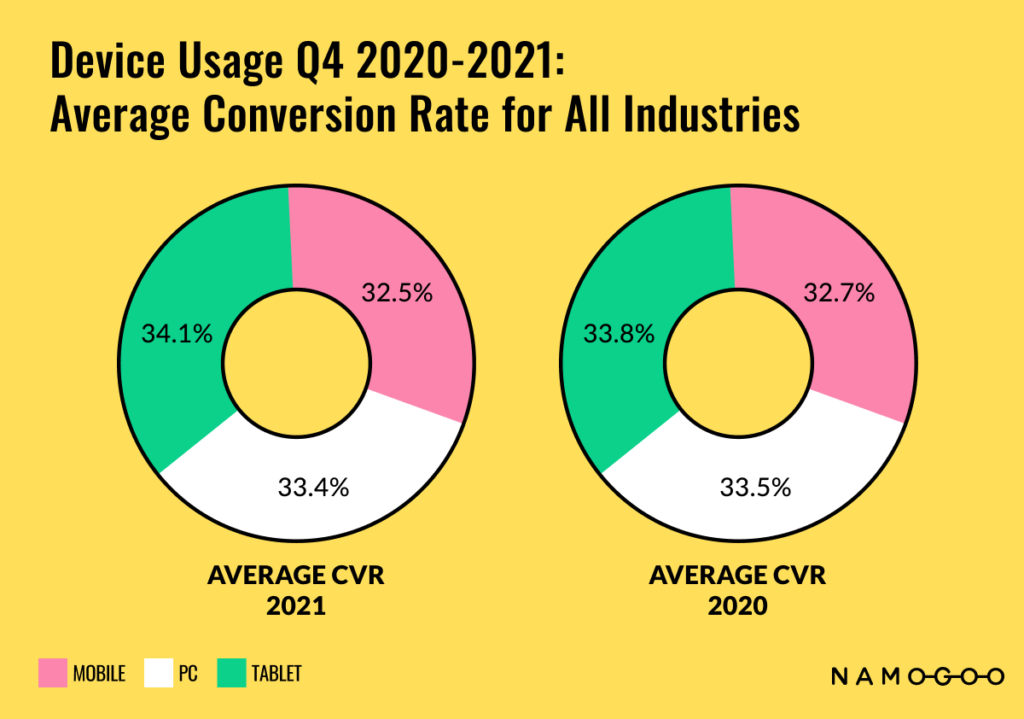

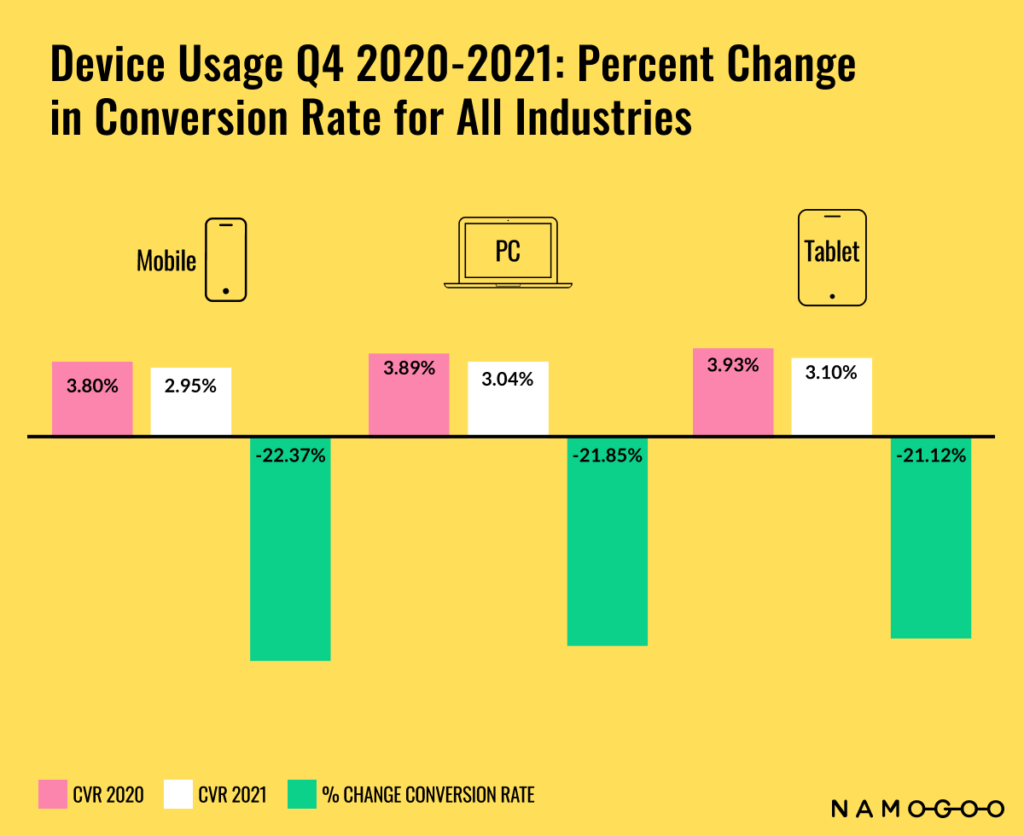

Buying More with Handheld Devices

Shoppers continued to shop on handheld devices more than desktops. While more PC conversions happened by 0.1% in 2021 compared to 2020, the majority of CVRs occurred on tablets and mobile devices in Q4 last year, reaching 66.6% combined.

To keep up with consumers in the new year, brands should explore creating not only mobile-responsive shopping experiences, but also mobile-only customer journeys from product search to the promos that shoppers get. The limited real estate as well as the easy access to handheld devices make them a crucial touchpoint throughout the shopping journey.

Actionable Tips to Consider for Optimizing eCommerce Experiences This Year

- Remove interruptions from the journey, making it as smooth as possible. The increasing number of shoppers exposed to competitor ads and browser extensions in half of all industries in Q4 2021 is a huge opportunity for retailers to take back from hijackers. Retailers aiming to keep shoppers within the brand experience can consider different ways to remove frictions and ensure continuous customer journeys. On-site, you can look into real-time shopper assistance, mixed reality tools for product exploration, and transparent returns and shipping options that shoppers can easily see throughout the buying process. Off-site, personalized emails and SMS can help save abandoned carts and checkout processes. Social media, on the other hand, can keep shoppers engaged, nurturing buying intent until they’re ready to buy.

- Explore novel ways to maintain engagement with digital shoppers. For many shoppers, eCommerce shopping has proven to be a lasting habit from the greater digital activities and on-and-off stay-at-home restrictions since two years ago. As consumers add more shopping destinations back into the mix in 2022, creating unique digital shopping experiences can guarantee ongoing traffic and engagement on online channels. You can further explore social and video shopping, gamification, and omnichannel fulfillment options, while ensuring shoppers are not exposed to unwanted ad injections.

- Prepare strategies and campaigns fit for a longer holiday shopping season. As shoppers anticipate starting holiday shopping early, this invites more brands to extend the average shopping duration. To prepare, retailers must closely monitor consumer sentiments and demands to adjust operations accordingly. Keep up with trending products that should be highlighted. Would Health & Beauty still lead growth in CVRs this year or another industry? Having visibility into online customer journey data can be a powerful way to boost relevant and seamless shopping experiences in addition to better inventory and supply chain management. To maximize resources, you can also explore tools that promote highly customized offers based on shoppers’ unique preferences.

- Make sure every connection with shoppers is intentional and relevant. The number of shoppers completing purchases on mobile, tablet, and desktop is almost the same now. This signals the need for intuitive shopping experiences that match consumers’ real-time intent and context. You can maximize budget and boost sales by zeroing in on the individual customer. From the homepage to checkout, as well as the various communications and promos delivered via email and SMS, personalizing every moment of interaction with customers can increase opportunities for a healthy bottom line in 2022.

Next Steps

2021 was a transition year as consumers adjusted to the changing definitions and realities of what’s normal. In 2022, shoppers are switching between eCommerce and in-store shopping more, but still with a stronger preference for online.

What does this mean for brands and retailers? It’s essential to ramp up online experiences and explore new channels, touchpoints, and journeys that matter to customers.

While the rapid acceleration in eCommerce from 2020 has started to reach normalcy, everything is still up in the air today. Brands and retailers who are agile and ready to adjust to dynamic conditions stand to win more shoppers not only this year but also next and beyond.