Bonus Material: Promotions Insight Survey 2021 – Shoppers Edition

Customer lifetime value: one of the most crucial metrics for eCommerce companies to monitor and benchmark against, but one many teams overlook in favor of focusing on conversion rate optimization.

It’s not enough to understand your customer acquisition cost or which ad audiences drive the highest return.

To be competitive, eCommerce teams need to pay attention to the true lifetime value of each customer and customer cohort and optimize the post-purchase journey.

The lifetime value metric provides crucial data about which segments of your audience:

- Drive the most revenue

- Are most likely to repurchase

- Become loyal brand advocates and champion your brand…

So you can improve profitability, increase recurring revenue, and keep your customers happy so they’ll keep coming back for more.

If you aren’t sure how to calculate and improve CLTV, this guide is for you. In this complete guide to customer lifetime value, we’ll walk through :

What Is Customer Lifetime Value (CLTV)?

How to Calculate Customer Lifetime Value

6 Ways to Improve Customer Lifetime Value (CLTV)

Drive eCommerce Profitability by Optimizing Your Customer Lifetime Value

If you are struggling to scale your business or reduce customer churn, CLTV should be a top priority. Here is what you need to know.

What Is Customer Lifetime Value (CLTV)?

Customer lifetime value, also referred to as CLTV or LTV is a metric that measures the net profit a company makes from one customer over the entirety of their relationship.

For example, if the average customer spends $1,000 a year with a brand and remains a loyal customer with your company for five years, your CLTV would be $5,000.

Unlike customer acquisition costs, which consider how much it costs to gain a new customer, CLTV helps businesses understand the long-term revenue potential each customer (or customer segment) creates.

And that is the key to long-term, sustainable eCommerce growth.

Why is Customer Lifetime Value Important?

Measuring CLTV provides valuable information about how effective your marketing is at driving new customers who are likely to stick around, where customers experience friction in their lifecycle with your brand, what causes customer churn, and how much you should invest in retaining customers.

For example, say, an eCommerce company finds that their Facebook advertising campaigns result in an ROI of $25 per dollar spent. That’s a pretty effective campaign, right? You might consider investing more in that campaign versus an email marketing campaign with an ROI of $10.

But ROI alone doesn’t provide the complete picture.

If the CLTV of customers acquired via email marketing is $2,000, while the CLTV from customers brought in via Facebook is just $100, this can help to inform where you should be spending your marketing budget for long-term profitability.

This valuable data is key for building a long-term, sustainable strategy for eCommerce growth by highlighting the channels that your team should focus on to bring in the types of customers who buy again and again.

Let’s say an eCommerce company sells both direct-to-consumer and to wholesale accounts. The costs to acquire and support productive wholesale accounts are much higher — bringing their CLTV down. By calculating the CLTV for both direct-to-consumer and wholesale customers, the company might find it’s more profitable to target consumers directly as they may cost less to acquire, onboard, and support.

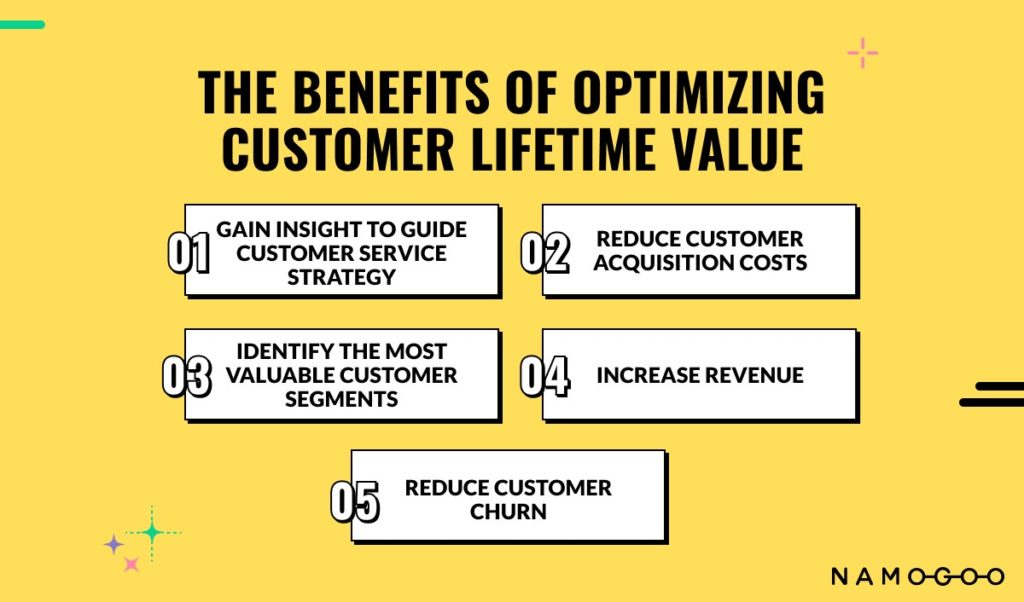

Here are a few more reasons why eCommerce companies, in particular, should pay close attention to CLTV:

- Get insight into how effective your customer service efforts are

- Identify which customer segments are more valuable to your company (so you can target them more effectively)

- Help reduce customer acquisition costs by targeting customers more likely to purchase

- Increase revenue by understanding the true value of each customer segment

- Reduce customer churn by using data to attract your most valuable customers.

Customer lifetime value provides a clear picture of your company’s long-term viability — and it gives context to other metrics, like minimum ROI required on any given marketing channel and how sustainable your customer acquisition costs (CAC) are.

How to Calculate Customer Lifetime Value

There are two main ways to calculate the customer lifetime value. Both methods have their pros and cons.

#1. Through Third-Party Data Tools

First, you can pull data from Google Analytics, Shopify, or whatever other analytics platforms you use. The problem with this is they don’t calculate the CLTV for you, so you’ll need to use another tool like Glew.io to calculate it.

Dealing with all the different platforms can be a hassle, and you don’t have much control over how they calculate the metrics. On the bright side, you don’t have to do any complex math, and you can probably automate the process.

#2. Calculate CLTV Manually

The second way is to use a customer lifetime value formula, which we’ll cover below. It’s a little more complex, but also customizable.

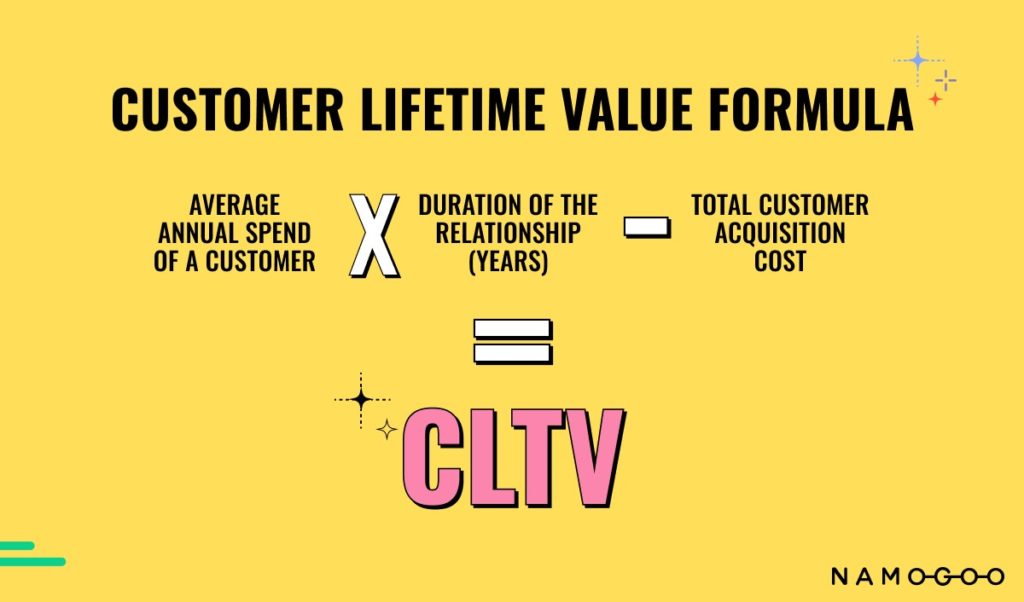

Customer Lifetime Value Formula

The most accurate way to calculate customer lifetime value is by multiplying the average yearly spend of customers by the average relationship length in years, then subtracting the costs of acquiring that customer.

Here’s the formula for customer lifetime value:

Average annual spend of a customer

X

Duration of the relationship (years)

–

Total costs of acquiring the customer

= CLV

Let’s look at a customer lifetime value example to see how this works in practice.

Examples of CLTV

Say a pet owner spends $400 per year with a pet supply eCommerce company, with an average relationship of five years, and an average acquisition cost of $50. Let’s plug those numbers into the formula above.

$400 X 5 years – $50 = $1950

As you can see, it is pretty simple. However, calculating CLTV isn’t always quite that easy. There are other costs your business might want to consider.

What happens if your customer spends aren’t static year over year or you need to factor in the cost of retention?

You can start by averaging out yearly spend — so if a first-year customer spends an average of $700 the first year, $500 the second, and $350 for the next three years, their average annual spend is $900.

You might want to consider other factors, such as the cost of retention discounts, inflation, and customer support. All these factors can be subtracted from the total CLTV to provide a more accurate number.

CLTV can be calculated for specific segments of your audience, as well.

Let’s look at a customer lifetime value example for a shoe brand.

A runner might spend an average of $80 per year on running shoes, with an average relationship length of five years, while a parent with three kids spends an average of $300 per year, with an average relationship of three years.

Here’s the CLTV for a single person:

Average annual spend $80 X 5 years = $400

Now let’s look at the CLTV for the parent with three kids:

Average annual spend of $300 X 3 years = $900

You’ll notice we didn’t include the acquisition costs in this calculation. That’s because you can also use CLTV to determine where you might want to invest more in acquisition.

In this example, the parent is more than twice as valuable, so it likely makes sense to spend more on acquiring those customers. (Depending, of course, on how much those customers cost to acquire.)

Customer lifetime value calculations can also vary by industry. For example, a SaaS company will have to consider onboarding costs. So, the CLTV formula might look like this:

Average annual spend X average customer relationship – average acquisition cost – average onboarding cost of $500 = CLTV

Calculating your CLTV on your own takes a few more steps, but provides much more valuable data.

6 Ways to Improve Customer Lifetime Value (CLTV)

CLTV is arguably one of the most important metrics for sales and marketing teams. Because it can be calculated for specific cohorts of customers, it can help you prioritize ad or marketing budgets to focus on your most valuable customers.

But, calculating your CLTV is only half the battle. What if your CLTV is low? Let’s look at four strategies to improve your customer lifetime value and drive revenue.

#1. Ensure Customer Success With Your Company

Poor customer service is the top reason customers leave a business[*]. It doesn’t matter if your products are the best thing since sliced bread; customers will leave if your customer service is terrible.

That means improving customer service and focusing on customer success is the best way to improve your CLTV. Here are a few ways to provide the support your customers need to stay happy:

- Omni-channel support: Make sure your support team hangs out where your customers are, including social media, email, and phone. Systems like Salesforce, Zendesk, and Freshdesk allow support to pick up conversations with customers across platforms.

- Live chat or chatbots: Adding a chatbot or an instant messaging option to your checkout flow can lower your support request workload and provide the customer support your audience deserves.

- Create a knowledge base: Not every customer problem requires a live customer service rep. Especially for bigger ticket items, like tech, home goods, and health products, a knowledge base can give your customers the knowledge they need to succeed with your products. Developing detailed how-to videos, FAQ sections, and a forum where customers can ask questions reduces call volumes while providing customers with the information they need.

- Provide a seamless shipping experience: Delighting your customers with fast shipping, delivery status updates, and an elevated unboxing experience does more than just earn you 5-star reviews. These touches can mean the difference between a one-time purchase and a lifelong customer.

- Ensure a generous return policy: Your refund and exchange policy is an important element of customer success. A customer who feels they’ve been treated fairly is more likely to buy again, and a solid money-back guarantee also shows your company has confidence in your products.

There’s a lot that goes into ensuring customers are successful not only with your products but also with your company. This is a key focus area of retention teams.

#2. Personalize the Customer Experience

Personalization is a pillar of customer retention.

61% of online shoppers surveyed stated they’re more likely to buy from a personalized offer that’s customized to their specific needs.

And our survey of 100 senior eCommerce executives from companies with online annual revenues ranging from $15M to $1B and more, showed that 55% are focusing on improving onsite personalization to increase eCommerce revenue.

But as powerful as personalization is for conversion, it’s even more powerful for customer retention.

Read More: Personalized Marketing: What It Is & How to Use It to Drive Loyalty & Sales

There’s nothing that drives customer lifetime value like tailoring the customer experience to each shopper because it communicates that your company cares about who the customer is as an individual.

Collect and make use of data to personalize the customer experience. Try these eCommerce personalization strategies to drive customer loyalty:

- Survey your customers for better segmentation: Once you’ve already converted a visitor into a customer, you’re in a good position to reach out to get more information about them. Send an email in your post-purchase drip sequence asking them for more information about them, and use their answers to segment them for more personalized messaging. For example, my company FLIGHTFŪD sends an email in our post-purchase flow that asks why each customer travels. This helps us to tailor the offers, content, and messaging that flight attendants see vs business travelers or leisure travelers.

- Celebrate meaningful events and dates: Send happy birthday or anniversary messages with a discount or small gift to recognize and acknowledge your customers. You can collect this data by having your customers make an account or join a loyalty program.

- Drive repeat purchases through personalized product offerings. Use the customer’s purchase data along with clickstream data to personalize the products you promote, and the offers you send to them. Provide better offers on the products they usually buy to incentivize repurchasing, and build custom bundles to introduce them to new products they’d likely enjoy. For example, if a customer doesn’t eat pork but loves chicken, ButcherBox would do well to avoid offering her their Beef & Pork box in favour of an offer on their boxes that include chicken.

Personalization keeps customers coming back, develops loyalty and builds brand equity.

#3. Provide Data-Driven Offers Based on Customer Intent

Unlike loyalty programs, which reward all customers the same way, intent-based rewards focus on each customer’s unique signals by leaning into customer intent. This is more effective than offering a blanket 10 percent off coupon or a standard “spend $100 and get a gift” reward system.

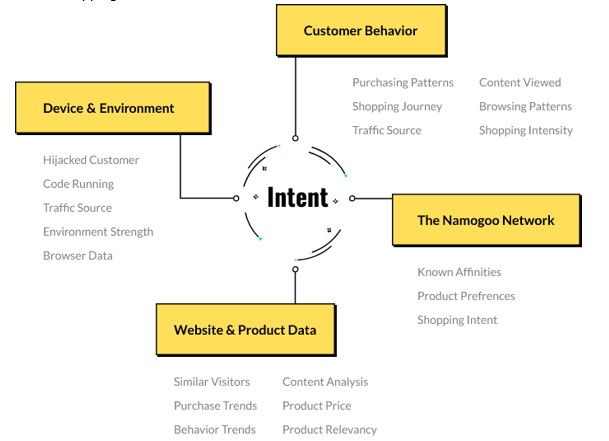

Instead, use behavioral data to understand what rewards encourage specific customers to take action. Namogoo’s Intent-Based Promotions does this through analyzing data from billions of online shopping sessions to understand what motivates each customer:

For example, you can track customers to understand that free shipping is likely to encourage one customer to make a purchase, while another is more likely to respond to a buy-one-get-one offer.

In addition to improving your CLTV by encouraging customers to return, intent-based rewards and promotions also reduce discounting rate by offering the minimum offer needed to drive customers to convert.

#4. Refine Your Customer Onboarding Process

Poor customer “onboarding” is one of the main reasons customers stop buying from a business.

Consider this — if customers don’t understand how to use your product, they won’t understand its value. And when they don’t understand the value, they have little incentive to keep buying.

Let’s take Namogoo customer, Deciem, as an example. Deciem is the company behind the popular skincare brand The Ordinary. If a customer orders an acid from The Ordinary, and doesn’t receive any information about how, when, and how often to use it, they could:

- Over-use it and destroy their skin’s moisture barrier

- Under-use the acid and see no benefit to the product

- Apply the product at the wrong time of day (like right before they spend the day in the sun) and get unintended results

- Fail to get the full benefit of the product because they didn’t use a complementary product.

These problems can be solved through a strong customer onboarding process.

This process will vary based on your industry, products, and customer segments.

For example, more complicated products like technology should include training in their onboarding process, while a pair of running shoes likely won’t.

Here are a few tips to improve the customer onboarding process — and increase your CLTV.

-

- Make using your product easy: Schedule drip email campaigns to automate the process. Share easy-to-understand videos, product tutorials, and materials describing the value propositions of the products each customer purchased to ensure they understand how to use and get the most value from your products.

- Personalize the onboarding experience: Make sure all your information is relevant by personalizing the onboarding experience. Our example shoe brand may attract both athletes and busy parents as customers, and the information sent to each segment should differ based on their needs. Provide materials that highlight the features and benefits for each customer profile.

- Focus on benefits for the customer: Don’t just explain what your product does; explain how it can improve the customer’s life. What end result can they expect? How will that benefit them in the long run?

- Build a relationship. Consumers don’t become loyal to products, they become loyal to brands. Brands are unique entities with different stories, interesting philosophies, and compelling brand values. Communicate the elements that make your brand unique often; these are the factors that help to build a relationship with your customers.

- Build over time: Don’t overwhelm your customers by explaining every detail at once. Instead, send emails or training over time so customers can learn at their own pace.

By improving the onboarding process, your customers will better understand the value your company delivers and keep coming back, increasing their lifetime value.

#5. Incentivize Repeat Purchases

Online shoppers have options.

This makes it great to be a consumer. When you’re in the market for a product, you can shop around to find the best value.

It also makes the internet a distracting place. Newsfeeds littered with ads for competitor products and email inboxes full of messages from brands can quickly draw your hard-won customers in to buy from someone else.

So ensuring you are top of mind when it comes time for your customers to re-buy is key. Incentivizing repeat purchases can keep your customers out of the traps of competitors.

You can accomplish this in a few different ways:

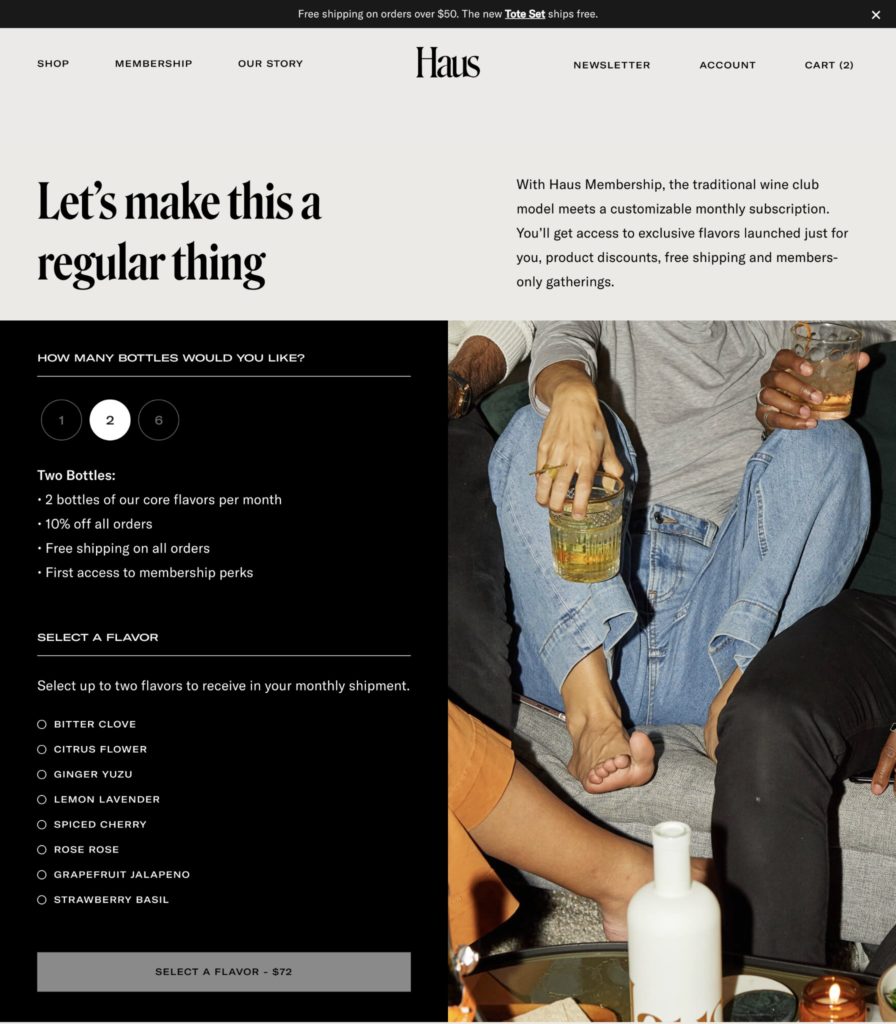

Make repurchasing a no-brainer with subscriptions: If your company sells products that are used regularly and/or need to be repurchased often, consider offering a subscription option to improve lifetime value and retain customers. Letting your customers subscribe to an auto-ship program takes the heavy lifting off the customer because they don’t have to remember to order in time, and it secures monthly recurring revenue for you, the eCommerce brand. For example, the innovative aperitif brand Haus offers a monthly membership to their customers that allows 10% off plus free shipping:

- Repurchase discounts. Offering discounts or promotions on either the products your customer has already purchased, or high-retention products your customers haven’t yet tried can incentivize ordering from you rather than a competitor. To protect your margins, try offering a buy more, save more type of discount to avoid shipping just one unit at a discounted price.

- Reward customers with a loyalty program. Loyalty programs make sense for brands and consumers alike. For the customer, it makes repeating their purchase with you more valuable because they collect points or other rewards. For brands, it incentivizes the repeat purchase and keeps your brand top of mind.

Incentivizing repeat purchases gives your customers the nudge they need to buy from you rather than seeking a competitor.

#6. Collect Feedback From Your Customers

How do your customers feel about your company? The best way to find out is to ask.

Consider sending out customer surveys like NPS (net promoter score) and CSAT (customers satisfaction score) to gauge how customers feel about your brand.

NPS is a one-question survey that asks how likely the customer is to recommend your brand to friends or colleagues on a 0-10 scale. Because it’s short, this type of survey is easy for customers to fill out and can provide a clear gauge of customer satisfaction.

CSAT asks questions like, “How satisfied were you with your recent purchase?” The surveys provide more detailed information but may have a lower response rate. Keep in mind that more closed-ended questions can skew your data.

Whichever format you use, leverage the data to understand how happy customers are with your brand and find ways to improve. Make sure to follow up with unhappy customers and find a way to make it right. Happier customers spend more money and stay around longer — improving your CLTV.

Drive eCommerce Profitability by Optimizing Your Customer Lifetime Value

Customer lifetime value is one of the most important metrics for eCommerce companies to track. It can be calculated with a simple formula and can be easily adjusted to fit your business’s unique challenges.

Improving CLTV requires showing customers you value them and provide what they need when they need it — whether that is a better onboarding process, more resources, intent-based rewards, or a simple follow-up.