Consumer Survey: Online Shopping During and After COVID-19

The COVID-19 crisis has forced consumers to change their shopping habits rapidly, pushing many to either increase their online spending or try shopping online for the first time. Although eCommerce has steadily been on the rise for many years, this is the first time we have seen such a sudden and widespread shift from shopping at brick-and-mortar stores to shopping online.

To help retailers and eCommerce companies adjust their customer journey to address these changes, we recently conducted a survey of U.S. consumers. The following pages highlight some of our most notable findings.

These results provide valuable and practical lessons for companies that rely on eCommerce – shedding light both on the ways COVID-19 is affecting the online customer journey today and on the ways consumers expect their shopping habits to change after the crisis has passed.

About This Report

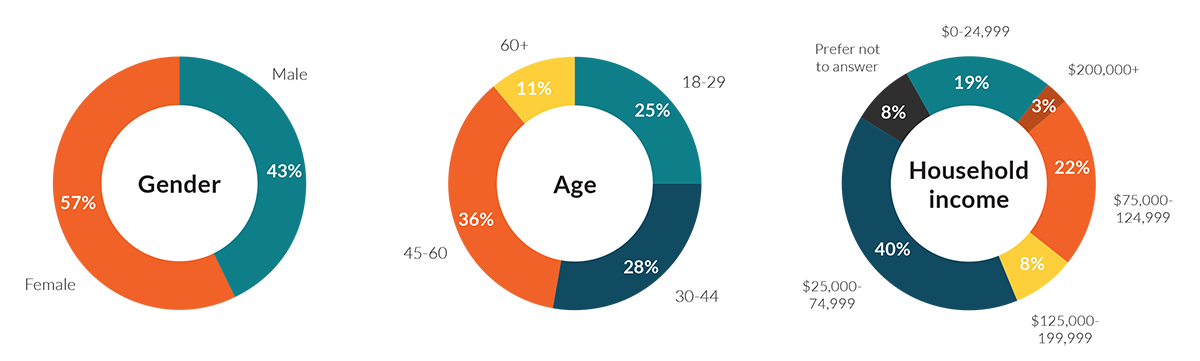

This survey was conducted by Namogoo in late April 2020, with responses coming from a diverse sample of 1,091 adults from throughout the United States.

Note: Numbers are rounded to the nearest percent and may not add up to 100%.

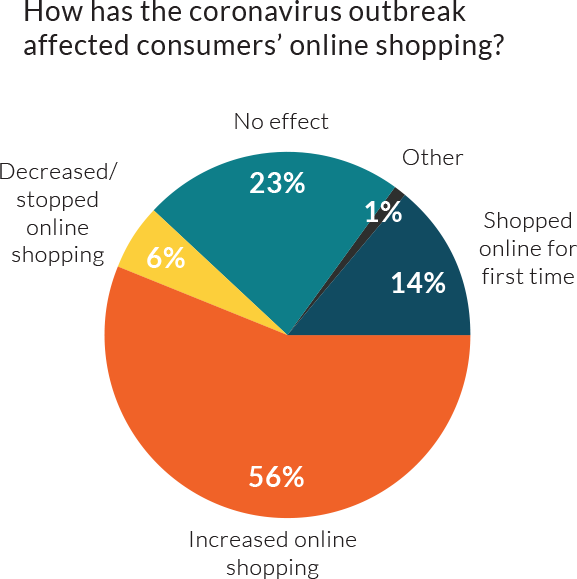

14% shopped online for the first time while 56% increased their online spending

The outbreak has made eCommerce a far more central part of consumers’ shopping habits than it was previously. Although most respondents had already made some purchases online, the crisis pushed them to boost their online shopping – while also encouraging a significant number of them to turn to eCommerce for the first time.

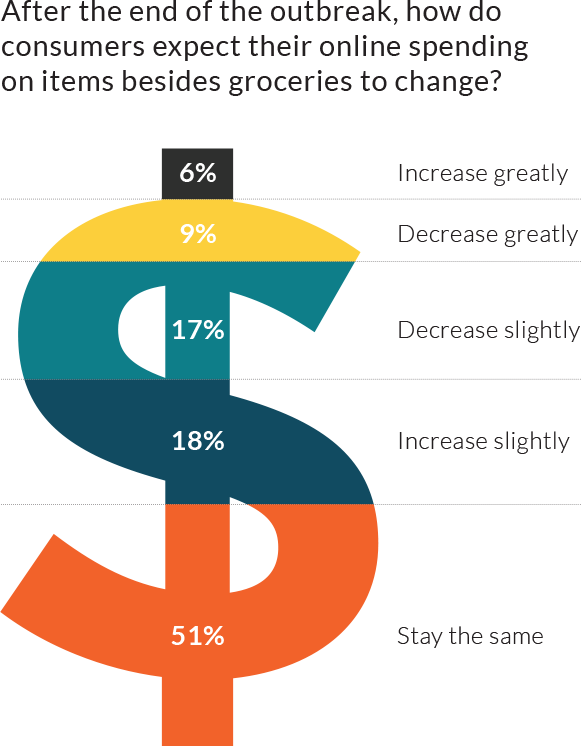

After the outbreak, 75% expect to maintain or increase their online shopping

In light of the increases in online shopping that we have seen since the start of the COVID-19 crisis, we wanted to find out whether this trend would continue after the end of the crisis. Encouragingly, we found that 51% said they plan to shop online after the outbreak at least as much as they do today, and 24% actually expect to increase their online shopping.

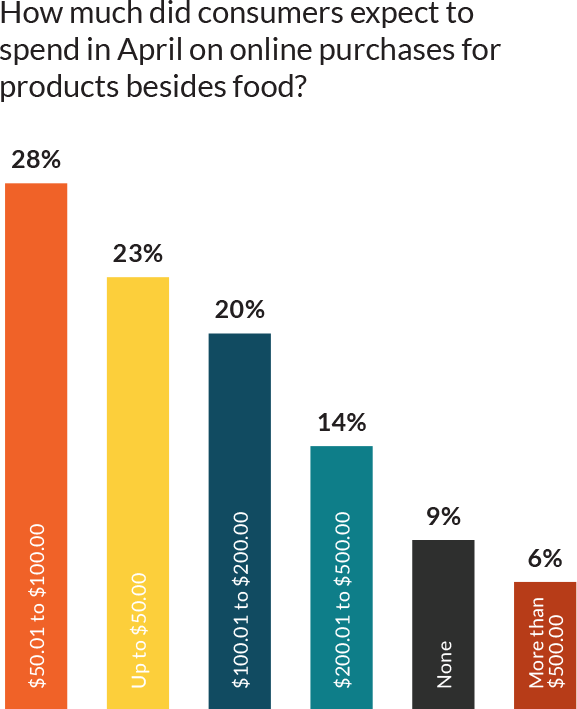

40% expect to spend more than $100 per month online

As of the time they completed the survey, a whopping 91% of respondents had either already made at least one purchase online in April or expected to do so, not counting groceries. And 68% expected their online spending to top $50 by the end of the month.

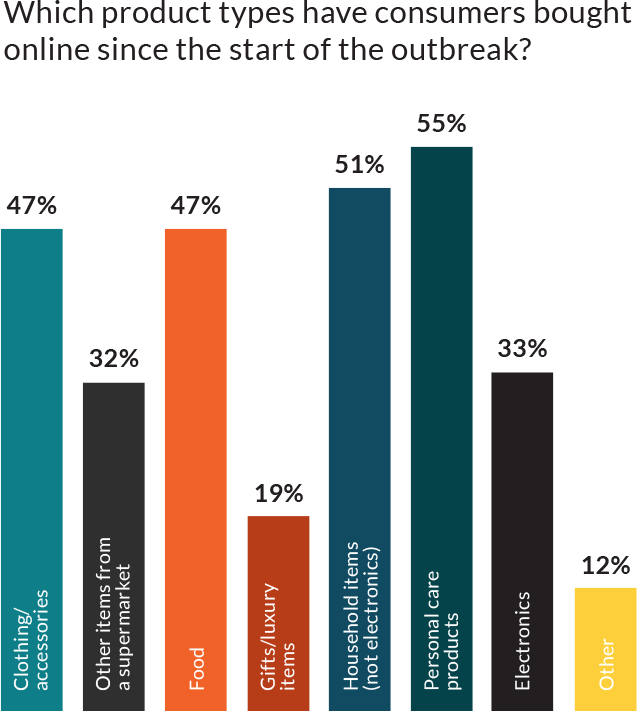

Over 45% recently bought clothes, household items, and personal care products online

Since the start of the outbreak, more respondents had bought personal care and household items than any other type of product. Food and clothes followed close behind in popularity, with slightly less than 50% of respondents saying they had made these kinds of purchases during the outbreak.

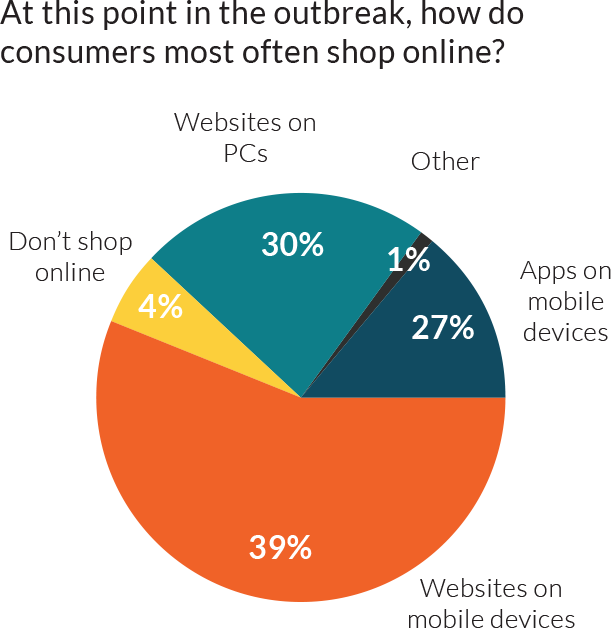

Only 27% shop online primarily from native mobile apps

The vast majority of respondents said they shopped on websites more often than mobile apps – a notable finding in light of challenges that can distract visitors when visiting online shopping websites. Without the brand-focused environment of a native mobile app, shoppers are more susceptible to disruptions such as unauthorized ad injections.

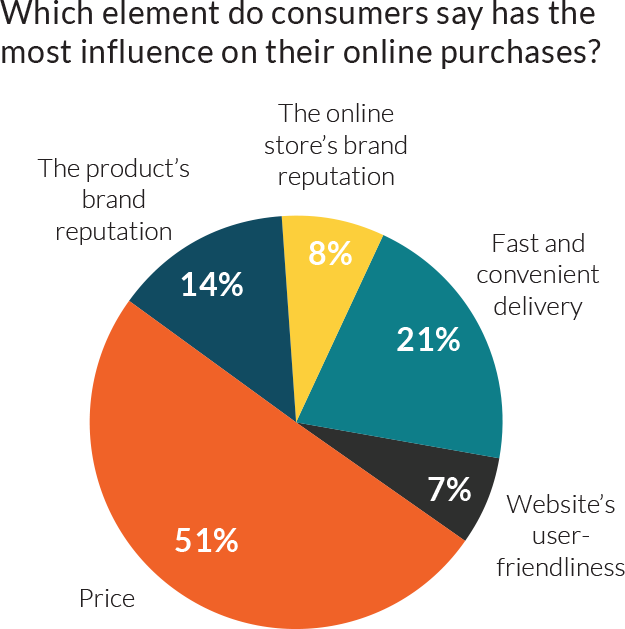

51% of shoppers are highly price-sensitive during COVID-19

To gauge which factors most affect consumers’ online shopping decisions during the coronavirus outbreak, we asked respondents to rank five factors from most to least important. More than half of respondents ranked price first, and a total of 75% said price is one of the two most important factors in their purchase decisions.

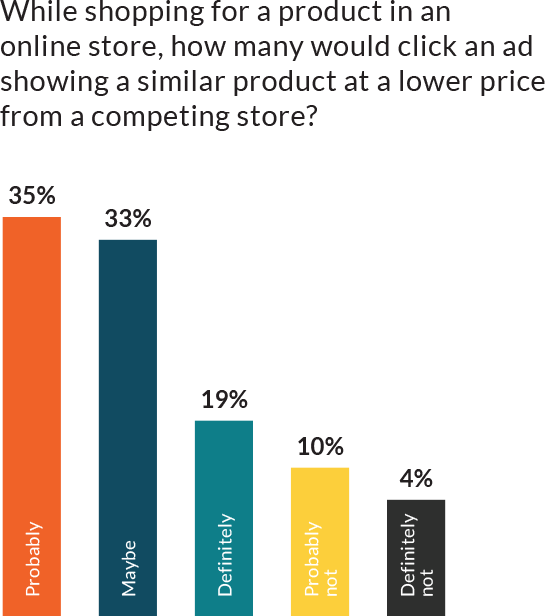

54% of consumers are likely to click on injected ads

Injected ads featuring competitor promotions feature in over 20% of all online shopping sessions throughout the year. When we asked participants about how likely they would be to click on an ad appearing during their session that offered them a lower-priced alternative, only 4% said they would “definitely not” click the ad. This finding underscores how consumers’ distractibility and price-sensitivity can hurt retailers’ sales numbers, especially given online shoppers’ typical use of websites rather than apps.