Remember when Black Friday and Cyber Monday used to kick off holiday sales, and eCommerce numbers were just one aspect of the shopping season? This year, eCommerce is what the holiday shopping season is all about, and major retailers’ holiday promotions have already been going on for weeks.

Now, a month and a half after Amazon’s postponed Prime Day effectively kicked off the holiday shopping season, the jump in online sales is going strong. While that has taken some of the emphasis off of Cyber Weekend — the 4-day period covering Black Friday, Super Saturday, and Cyber Monday — this mega shopping weekend still saw a significant increase in online sales as compared to last year.

With Cyber Monday now in the rearview mirror, retailers now have an opportunity to look at the recent online sales KPIs from various industries and see what those metrics tell us about this holiday shopping season. We analyzed over 500 million eCommerce visitor sessions to help online retailers capture consumer behavior trends from Cyber Weekend and leverage them to make the most of this season’s sales potential.

With that in mind, we at Namogoo have been watching to see how our clients’ eCommerce KPIs from Cyber Weekend compare with their numbers from the same period last year – and what we can learn from those comparisons. Here’s a look at our key findings:

Online sales up over Cyber Weekend despite earlier promotions

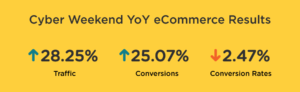

Although many retailers started launching Black Friday-style promotions as far back as Prime Day, this Cyber Weekend saw an increase in eCommerce as compared to the same period in 2019, with 28% more traffic and 25% more online sales.

Interestingly, amidst these increases in traffic and conversions, conversion rates actually dipped slightly. But looking at major trends that have emerged in 2020 in the wake of COVID-19 can help retailers put this in perspective. The first is a historic shift towards eCommerce leading to major increases in online shopping throughout much of the year. Then comes the unprecedented influx of first-time online shoppers, which presents significant growth opportunities and challenges for retailers competing for their loyalty.

This Year’s Industry Winners

Which industries managed to outpace last year’s eCommerce results for Cyber Weekend? With COVID-19 still such a powerful influence on consumer shopping priorities, three industries posted exceptionally dramatic jumps over their 2019 numbers: Online supermarkets, online health and beauty stores, and homeware and improvement sites all saw their Cyber Weekend 2020 sales more than double those of the previous year.

Mobile Dominates Traffic and Sales Again

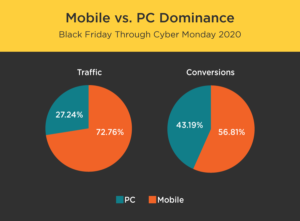

Last year’s eCommerce holiday season was the first that we saw more online shoppers convert on their smartphones or tablets than on their PCs. So far this year, we’re seeing this trend continue: Over 72% of traffic to online retail sites came from mobile devices between Black Friday and Cyber Monday. Meanwhile, 56% of all online purchases were made via mobile devices.

Cyber Weekend showdown: Black Friday vs. Cyber Monday

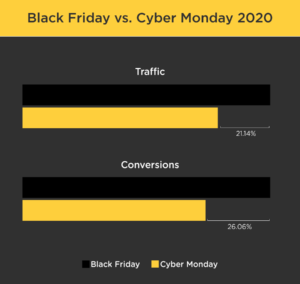

While the Cyber Monday phenomenon is growing outside of the U.S., looking into our data for eCommerce retailers globally showed that 2020’s record-setting Black Friday still netted more online orders than Cyber Monday. Not only did online retailers see more total traffic on Black Friday than Cyber Monday, but the numbers show that these visitors were more inclined to make purchases.

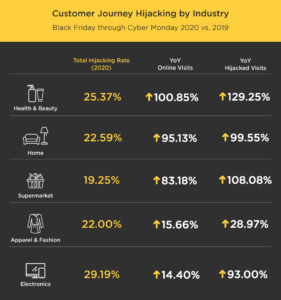

Injected Ads Hijack Over 22% of Cyber Weekend Customer Journeys

Cyber Weekend saw a marked rise in online sales as compared to last year, but these four days also saw a dramatic increase in Customer Journey Hijacking – an expensive problem that routinely costs retailers in lost sales. Namogoo’s consumer session data from Black Friday through Cyber Monday identified that 22.26% of all eCommerce site visits were exposed to unauthorized ad injections.

Diving into our industry traffic data shows that the industries with the most notable increases in online visits during Cyber Weekend also saw significant spikes in the number of hijacked visits. For retailers in these industries, the percentage of visitor sessions subjected to ad injections ranged from 19% to 29% during this peak eCommerce weekend.

Boosting Sales by Removing Competitor Ads

Over Cyber Weekend alone, retailers preventing Customer Journey Hijacking with Namogoo increased approximately $175 million in eCommerce revenue directly with our consumer-side technology, which automatically identifies and blocks consumer-side ad injections in real time.

Why is this such an expensive problem for retailers? By displaying injected ads to online shoppers visiting a retailer’s website (typically ads promoting competitors’ products), Customer Journey Hijacking damages the online shopping experience and encourages prospective customers to leave before making a purchase.

Moreover, Customer Journey Hijacking disproportionately affects the most active online shoppers, often preventing retailers from effectively reaching their most promising target audience.

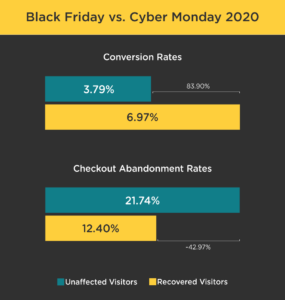

Our numbers from Cyber Weekend provide a window into this pattern: After Customer Journey Hijacking was blocked, recovered visitors (shoppers previously impacted by ad injections blocked by Namogoo) had a conversion rate of 7% — a whopping 84% higher than the rate for visitors who are unaffected by ad injections. Meanwhile, these recovered visitors had a cart abandonment rate of only 12% – a full 43% lower than other shoppers.

Making the most of the holiday shopping season

What do our eCommerce numbers show retailers about this holiday shopping season? Perhaps most importantly, they show that the predictions of a major online sales jump on and around Black Friday were well-founded, despite the increase in online sales over the past several weeks. Although some industries stood out more than others over Cyber Weekend, the general pattern is clear: While eCommerce has long been a growing source of sales revenue for retailers (especially during the holiday shopping season), this year’s peak sales period has seriously upped the ante.

In a year as full of challenges as 2020, the kinds of online sales numbers we have seen over the past week show that eCommerce isn’t just an increasingly useful business tool, but an opportunity that retailers can’t afford to miss. And in the face of unprecedented competition among online retailers, these companies need to bring their A-game when it comes to customer experience.

These numbers also show that Customer Journey Hijacking is increasingly preventing retailers from achieving their sales potential – hurting the online shopping experience and driving the most promising customers straight into the arms of competitors.

The good news is that, as online holiday shopping continues into December, retailers can tap into the technology needed to remove the problem posed by Customer Journey Hijacking. By automatically eliminating injected competitor ads, these companies can boost their ability to keep customers on-site – from homepage right on through to the bottom of the sales funnel.

Not only will this approach empower retailers to make the most of the potential that eCommerce offers them during this peak shopping season, it better equips them to build customer relationships to last into 2021 and beyond.

Ready to stop losing sales – and shoppers – to Customer Journey Hijacking? Act now to request cost-free access to Namogoo’s revenue-boosting Customer Hijacking Prevention technology through the end of 2020.